-

Getting started with Billit in 5 steps

With these 5 steps you're off and running in no time!

Read more -

The Billit invoicing platform

Discover the features that will save you time immediately in every step of your billing process.

Read more - Integrations

- Pricing

-

ResourcesSupportAbout us

ResourcesSupportAbout us

-

For whom?

-

Product

-

-

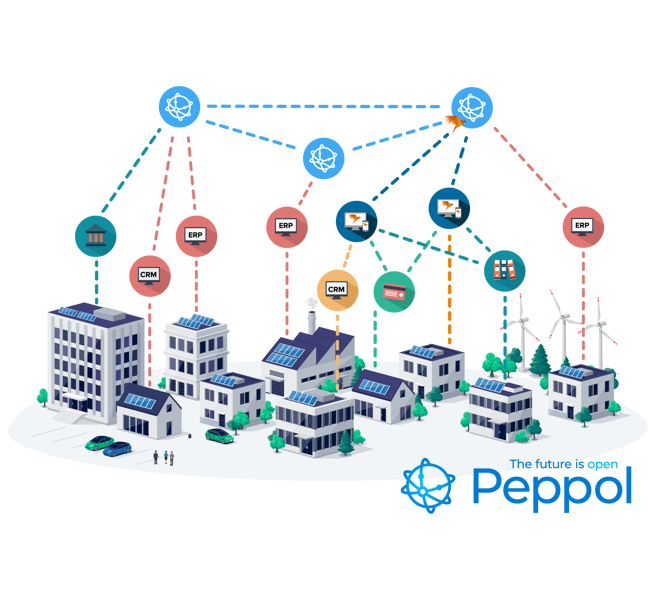

Peppol

-

-

ResourcesResourcesSupportAbout us

-

-

-

Support

-

English - International